Video tutorial : https://www.youtube.com/watch?v=R95cr34u4xY

◼️ Introducing AltLayer (ALT) on Binance Launchpool! Farm ALT by Staking BNB and FDUSD

Key points :

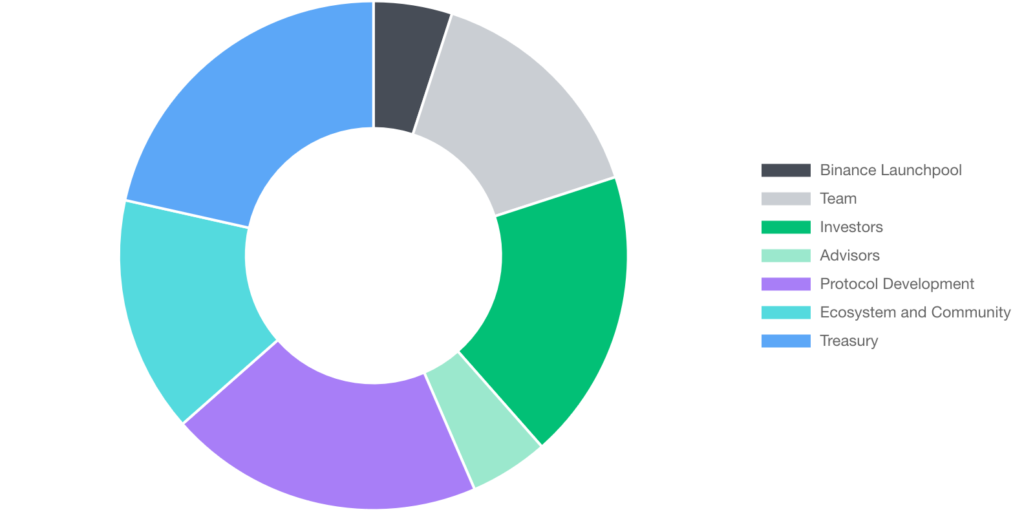

▪️ Max Token Supply: 10,000,000,000 ALT

▪️ Launchpool Token Rewards: 500,000,000 ALT (5% of max token supply)

▪️ Initial Circulating Supply: 1,100,000,000 ALT (11% of max token supply)

▪️ Smart Contract Details: BNB Chain, Ethereum

AltLayer Airdrop Season One – https://blog.altlayer.io/altlayer-airdrop-season-one-9148f6114c0b

◼️ ALT Token research by Binance

▪️ ALT Token Allocation : https://www.binance.com/en/research/projects/altlayer

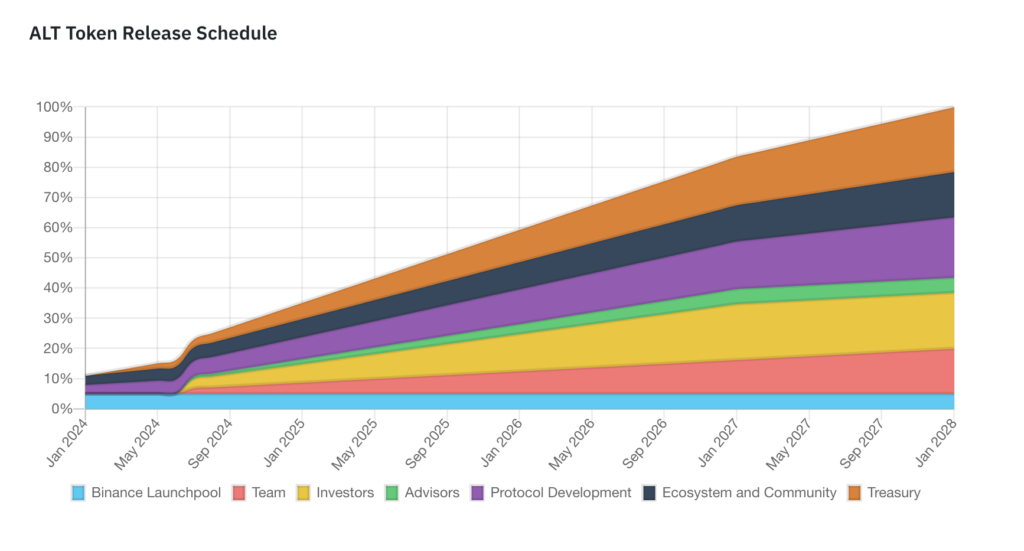

▪️ ALT Token Release Schedule :

https://www.binance.com/en/research/projects/altlayer

>> ▪️ JUN 2024

◼️ Roadmap and Updates

▪️ https://www.binance.com/en/research/projects/altlayer

ALT will be AltLayer’s native utility token and will be used in the following functions

▪️ Economic bond ALT token will be used alongside restaked assets to provide economic stake. This stake can be slashed if malicious behavior is detected.

It’s related to restaked rollup. The overall system architecture is as follows: We assume three system participants: a) user with ETH, b) a developer who wishes to commission a rollup, c) AVS operator

A user first stakes her ETH and then obtains an LST which she then restakes via EigenLayer. A developer who wishes to have a restaked rollup would then set up the AVS contracts to allow AVS operators to register for SQUAD (for sequencing), VITAL (for verification), and MACH for fast finality. Once these AVSes are set up and the operators are registered (provide economic security and bound to slash), they can start operating the rollup.

ALT can be used along side LST in this context to provide economic security.

▪️ Governance : ALT token holders can vote on governance decisions.

▪️ Protocol Incentivization : Operators in the AltLayer ecosystem can earn ALT tokens as rewards for their services.

▪️ Protocol Fees: Network participants will need to pay for intra-network services in ALT tokens.

◼️ NFT Holders : 107,130,000 ALT | Users : 2,157 (OG 389 + Oh ottie 1,768)

▪️ The non-circulating NFTs in our Treasury are not qualified to receive any ALT airdrop

If OG : Oh Ottie ratio 1:1 – 107,130,000 ALT / 2,157 [49K per OG/Oh ottie ]

1:1 ratio gives 30k for ottie and 137k for OG

1:2 ratio gives 20k for ottie and 183k for OG

1:3 ratio gives 15k for ottie and 206k for OG

◼️ Galaxy Holder : 111,210,000 ALT ( )

Phase – Number of Qualified Addresses

▪️Phase 1 (Testnet bridge) – 104,472

https://galxe.com/altlayer/campaign/GC5VuUyqHS

▪️Phase 2 (Beacon/rollup staking) – 83,418

https://galxe.com/altlayer/campaign/GCbkYUNBYs

▪️Phase 3 (Restaking/flash layer) – 150,674

https://galxe.com/altlayer/campaign/GCVBiU4Vub

▪️Phase 4 (FOGG) – 130,623

https://galxe.com/altlayer/campaign/GCuPiULrKh

If they allocate equal amount of ALT for each address

▪️ Number of Qualified Address: We have used anti-sybil analytics to identify non-sybil addresses that qualify for the airdrop. The selection criteria was:

▪️ A wallet address should have engaged with at least 1 on-chain transaction on the Ethereum mainnet besides participating in the AltLayer Altitude Campaigns for the past year (Ethereum block number 16107850 to 18769911) to be qualified.

Dec-04-2022 12:24:47 AM +UTC – Dec-12-2023 11:49:35 AM +UTC

▪️ Wallet addresses with the same source of funding are disqualified altogether. For instance, if more than 10 wallet addresses have received funds from one treasury account that holds a lot of funds and does not belong to a faucet, and these addresses perform similar trading behaviors at the same time, then these addresses will be deemed as one sybil cluster and will be disqualified.

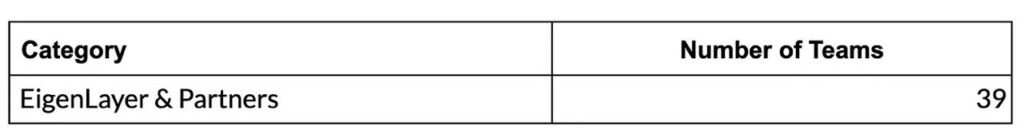

◼️ Eigen layer : 39,150 , 000 ALT

Restaked Points : https://docs.eigenlayer.xyz/restaking-guides/restaking-user-guide/restaked-points

Our core offering of Restaked Rollups leverages EigenLayer’s restaking mechanism and therefore, we have a dedicated ALT token pool for the restaking community.

◼️ EigenLayer Ecosystem Partners : 13,470 ,000 ALT

◼️Celestia stakers : 29,760,000 ALT

Due to technical differences in the claiming mechanism, we would make the airdrop to TIA stakers available for claim at a later time post-listing. We are working on the token airdrop portal for TIA stakers with the support of the Celestia team. Please stay tuned for updates. We apologize for not being able to get it ready pre-token listing. Rest assured that you will not be forgotten and we are doing our best to get it ready as soon as possible.

Binance Launchpool research – Airdrop LK – https://docs.google.com/spreadsheets/d/1OHYY0fP0nmt_L219fhyN6KrTMs_SoTxFvZgpwKOvCOQ/edit#gid=0

Moonshot : https://docs.google.com/spreadsheets/d/15Gph4kQSgfZ09t9hfBoX1BoqP4v6RMn9DQD5Kbn_wjk/edit#gid=0

What Is Fully Diluted Valuation (FDV)?

Fully diluted valuation (FDV) is the total value of a cryptocurrency project considering all of its tokens that are in circulation. It is used by investors to gauge the future potential of the project, just like the total number of issuable shares in the stock market.